We all know about Tata Motor, it is a big Brand in the Auto Sector, but why did Tata Motor’ share price fall from 1065, its 52-week high, to 675.50? Why is Tata Motors facing a bad time? There can be many reasons, like high interest rate, dollar, rupee, late start of business in the EV and Hybrid Car Sector, and the high cost of materials. Let me explain to you in detail below

Late Start in EV and Hybrid Auto Sector

Many Car Comany started producing EV and hybrid cars a decade ago. Tesla launched its first EV in 2008, BYD launched in 2010, BMW launched in 2013, Mercedes launched in 2014, along with they launched hybrid Cars. It means Tata Motor lacks experience and trust for customers who have already been built by other car companies for their customers. I mention an image (1) for visual details.

image(1)

high dependency on outside suppliers

Tesla and BYD have vertically integrated factories:

o Battery production

o Motors

o Inverters

o Software stack

JLR depends on external suppliers, creating:

o Higher costs

o Less control

o More delays (especially for hybrid drivetrain & battery sourcing)

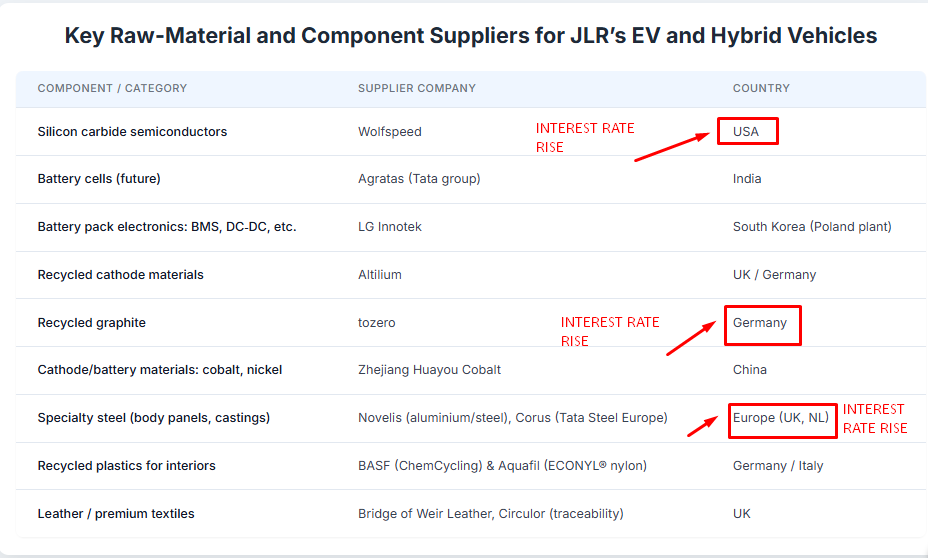

Impact of Hi1gh interest rates on Profit of Tata Motor(JLR)

High cost due to dependence on outside suppliers because Tata Motors imported from USA, EUROPE. There is a rising high interest rate, due to which the demand for Tata Motor JLR has slowed down because high interest means high cost of borrowing. here is below; I will mention a few negative impacts of high interest on Tata Motor(JLR)

high EMIs of car loans

high raw material cost

high inflation

Consumers focus on affordable cars

image(2)

Tata Motor Margin Pressure due to outside Suppliers

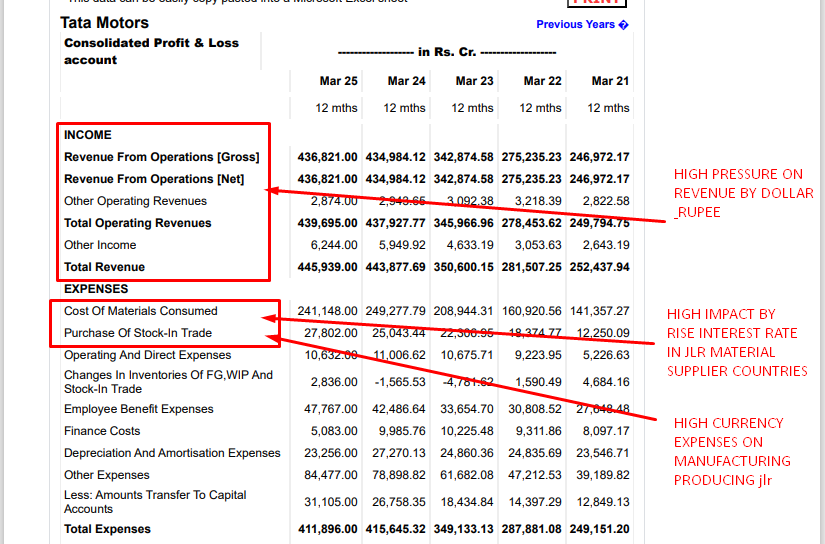

Tata motor margin pressure due to outside suppliers I mentioned a image(2) in which informed who are tata motor outside suppliers and due to suppliers from USA, EUROPE, CHINA. Tata motor cost of producing Tata Motor(JLR) becomes more expensive that is why Tata Motor facing high price Competition in Europe, the USA, and China. For more visual detail, I will mention an image(3) in which how high-cost raw material can impact the profit margin of Tata Motor

image(3)

Rise in interest rate of Supplier Countries to Tata Motor(JLR)

I have already given an image in which I have completely informed who the outside suppliers of Tata Motors are (image 2) and the impact of high interest on the cost of producing Tata motor(JLR) along with that, I mention image 3, which shows the impact of interest rates on the margins and revenue of Tata Motor.

I will mention an image (4) in which you can see the interest rate rise in Germany, the USA and UK except China. But Chinese Consumers looking for an affordable car with a good, trustworthy in brand in EV and hybrid car segments, the rise in interest rates indicates that everything has become more expensive than last

image(4)

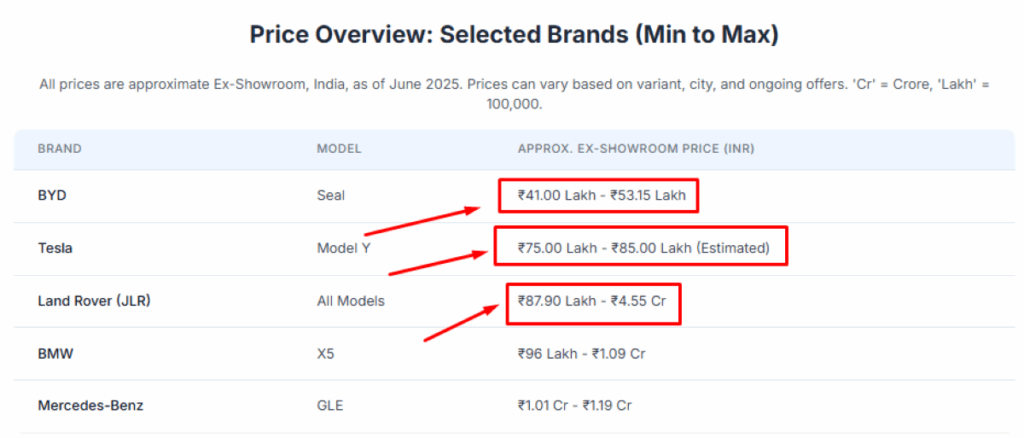

JLR is expensive than cars compared to Peers like BMW, TESLA, BYD, etc.

Tata Motor Car is so expensive for international markets like China, Europe and usa JLR’s Price range is between 87 lakh to 4.55 Cr, but there are many more affordable options available for international buyers, like BYD 41 lakh to 53 lakh, Tesla 75 lakh to 85 lakh, BMW 96 lakh to 1.09 Cr. so why do consumers choose JLR instead of these affordable companies? There are well-experienced to producing EV and Hybrid Car and they have already built a good brand in that sector Below i will mention a visual image(5) in which my reader can see the price of car companies

image(5)

Dollar and Rupee are high Risk on Margin

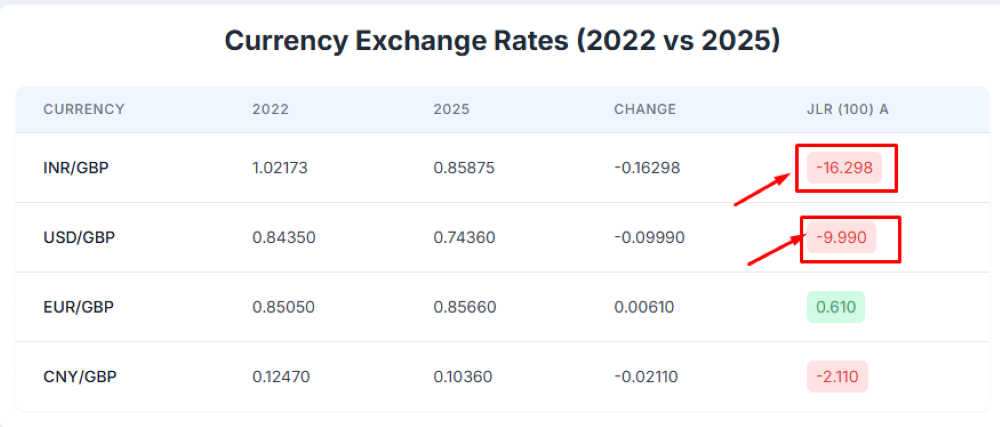

Tata Motor high margin pressure due to the dollar and rupee’s strength. which Suppose if JLR sold 100 Pounds amount of cars, It would incur USA loss of 16 Pounds and from India 10 Pounds and China 2 Pounds, euro mute. I will mention image(6) below to visually complete the informed table, and you can also see the image(3) for more clarification

image(6)

High impact on Tata Motor(JLR) Revenue and Margin due to strengthening dollar, rupee, and yuan against the British Pound

Tata Motors is facing high pressure on margin due to dollar, rupee, and yuan’s strength in the international market. I have already mentioned in image (6) about how Tata Motors is getting a loss in their profit and loss statement due to currency strengthening. For a more visual reality check, I will mention below a image(7) of currency exchange with British pound currency charts where you can easily understand GBP is weakening against all international currencies in terms of revenue in pounds and reporting in rupees.

image(7)