Introduction

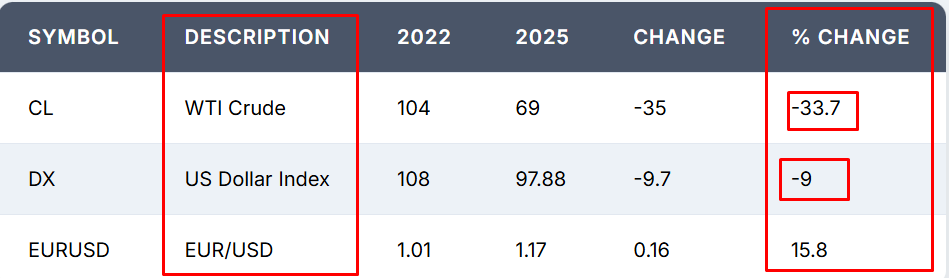

You know, from 2022 to 2025 lots of things changed in the global market, just like the dollar down, euro up, crude oil down, world major country index up, bond interest rise, all these things have already happen in the last three years. It means something bigger is happening around the world, it is something like a big negative thing is being ready to hit the global market like this title the $4 Trillion Flood : How Global Money Flows Are Creating the Next Big Crisis.

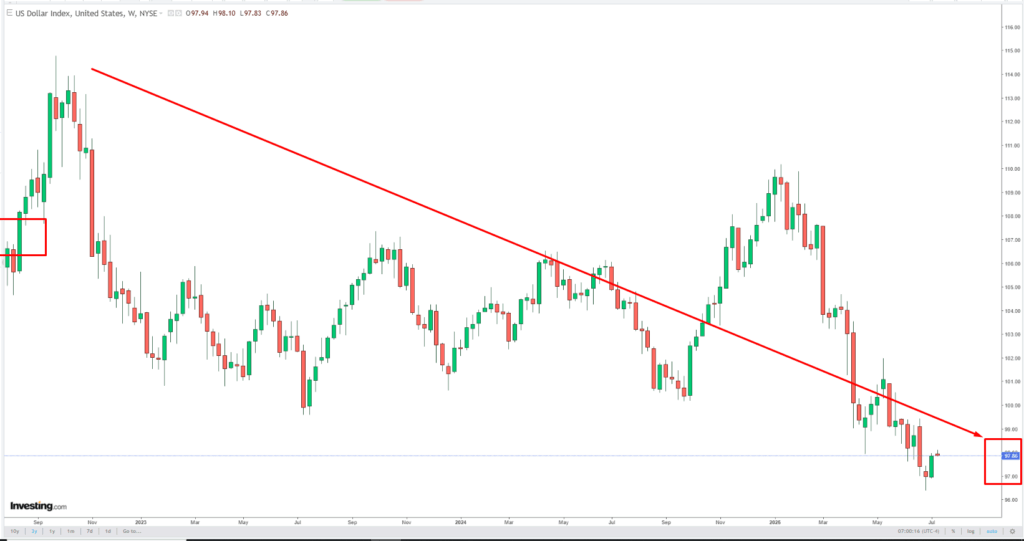

Dollar index

World biggest currency dollar slightly negative from $108 to $97.88 it implies global liquidity of dollar has decreased since 2022 that the signal other currency is increasing slightly against dollar in international market because dollar decrease its volume it indicating that global market equity is growing due to the low liquidity of dollar because of dollar euro currency is not depriciating it is a clear example when dollar decrease global market boom or bubble.

Crude oil declined 33.7% and the dollar index declined 9% Along with those negative reactions euro surged 15.8% This implies that the euro has an inverse relationship with both. It is a signal when dollar liquidity is reduced in global money flow, only when the euro increases, similar to crude oil, when crude collapses, emerging market demand increases, which increases the value of the euro

Euro

The second biggest currency rose from 2022 to 2025. 15.8% euro value, showing that the liquidity of the euro is increasing in the global market as well as the United States, that is why the world major index has risen robustly since 2022, when the euro rose. Other major currencies that trade against the dollar appreciate, which moves the global market new high.

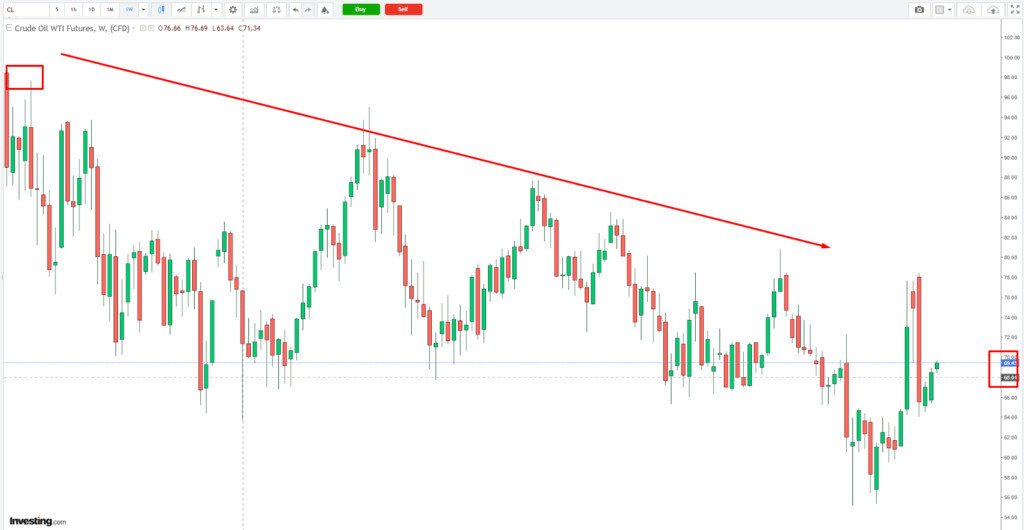

Crude Oil

Crude oil collapsed 33.7% it indicating that global energy demand has decreased due to a rise in interest rates in the global market, which is taking clear benefit of emerging markets based on low-cost products due to decrease price in crude oil that is why emerging market and global market equity rise because of low production cost due to Crude oil collapse price since 2022

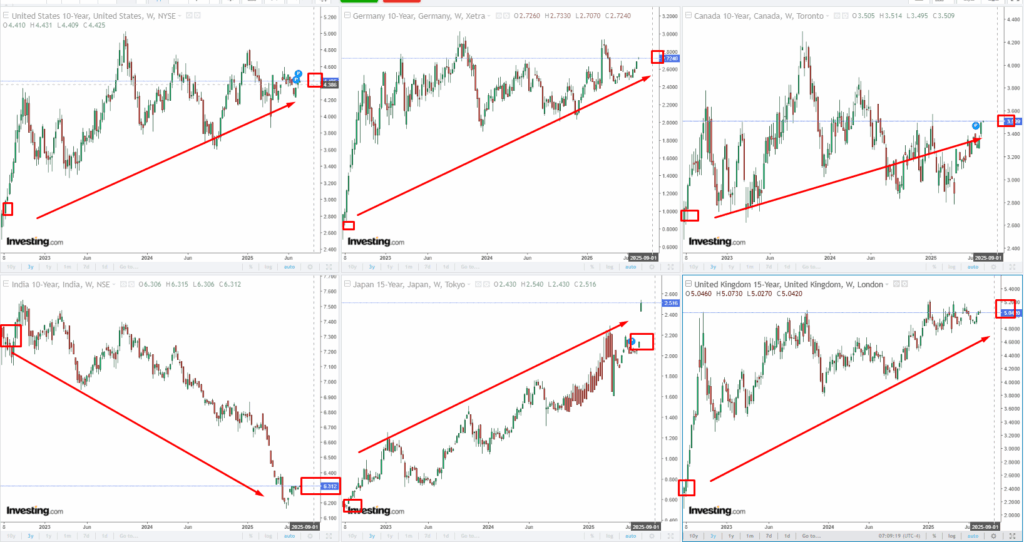

World Bonds

Global bond market intrerest rising since 2022 except india that implies india is growing despite global market market have increase interest rates all the major countries in the world their bond yield are increasing since 2022 that is showing that in their country cost of borrowing has slightly increase due to bond market and rose inflation, low demand and low corporate earning in their country.

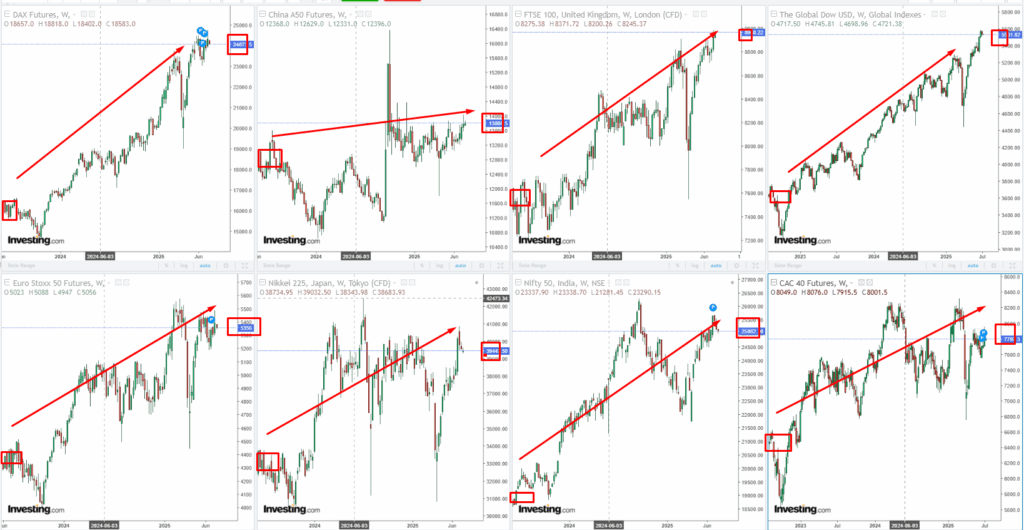

World Major Index

Due to the dollar index and rise in euro since 2022, major world indices have risen slightly a high level despite high interest rates and high cost of borrowing in their countries, as you already saw how global bond yield interest rise since 2022 despite that world major index rise because it is big reason that collapsed in crude oil price which increase supply of product and increase demand in emerging market.

Conclusion

The global market is in new hype due to the dollar decline and euro surge it creating a booming market since 2022 despite high interest rates and inflation around the world. It’s a money bubble in global equity driven by AI-powered equity and the crude oil price collapse. It could burst within the next 4 years due to AI reshaping the global economy and AI threat to global demand and human resources.